Often, a significant profit can be earned by the original owners as a result of the sale of their company. The entry increased the marketable security by $ 20 million on the balance sheet and cash decreased by the same amount. When the company purchases the others companies’ share equity, they have to pay cash and business transaction definition and examples chron com receive equity in exchange. Purchase of stock investment provides two main benefits to the company, in which the first one is that it can earn the dividend revenue from the investment. And another one is that it can enjoy the benefits from the value gain when the investee company performs well in the market.

Mục Lục Bài Viết

Balance Sheet $type=three$count=6$author=hide$comment=hide$label=hide$date=hide$show=home$s=0

It can be a strategic maneuver to prevent another company from acquiring a majority interest or preventing a hostile takeover. A purchase can also create demand for the stock, which in turn raises the market price of the stock. Sometimes companies buy back shares to be used for employee stock options or profit-sharing plans.

- Do you remember playing the board game Monopoly when you were younger?

- If thetransaction requires a debit greater than the balance in thePaid-in Capital account, any additional difference between the costof the treasury stock and its selling price is recorded as areduction of the Retained Earnings account as a debit.

- Assume that Bayless has been profitable and, as a result, a $0.20 per share cash dividend is declared by its board of directors and paid in December.

- The cost method is commonly used for this transaction due to its simplicity.

- As such, although the number of outstanding shares and the price change, the total market value remains constant.

Welcome to Accounting Education

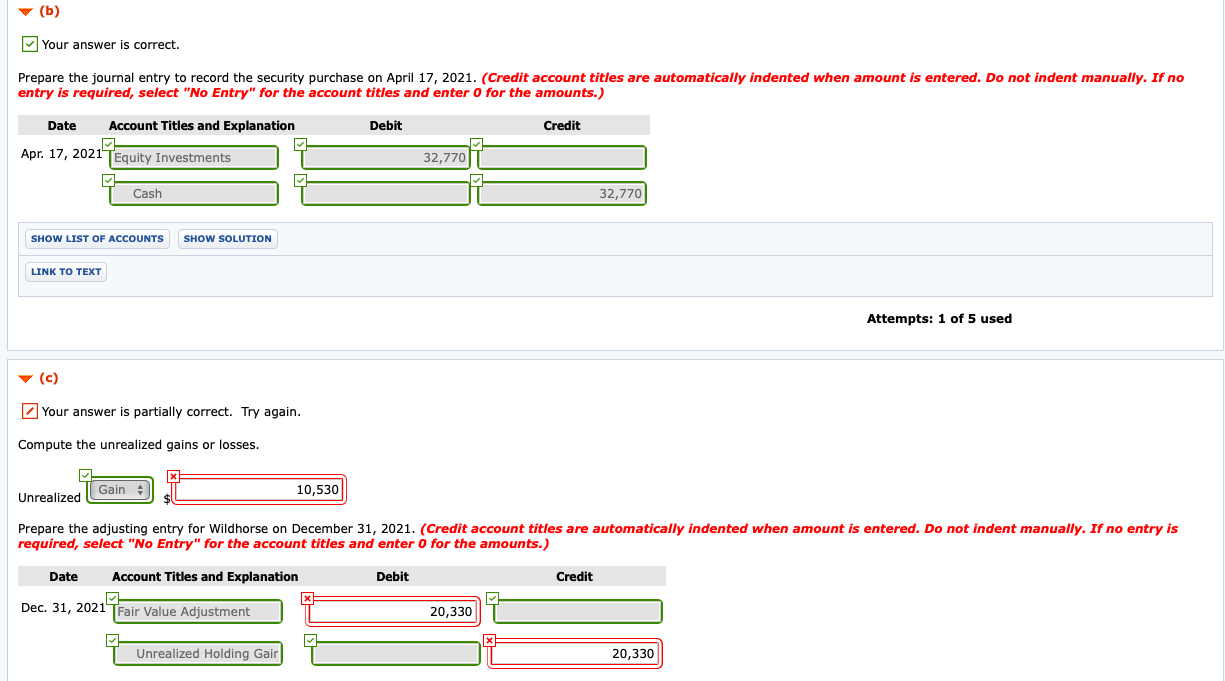

The general rule is to recognize the assets received in exchange for stock at the asset’s fair market value. In this journal entry, the par value or stated value of the stock, as well as the original issued price, is not included with recording the purchase of the treasury stock. This is due to the purchase of treasury stock is recorded at cost. In this case, we can make the journal entry for the $200,000 investment in shares of the ABC corporation by debiting this $200,000 to the stock investment account and crediting the same amount to the cash account. As mentioned, we may receive the cash dividend from the investment in shares that we have made in another company.

2: Analyze and Record Transactions for the Issuance and Repurchase of Stock

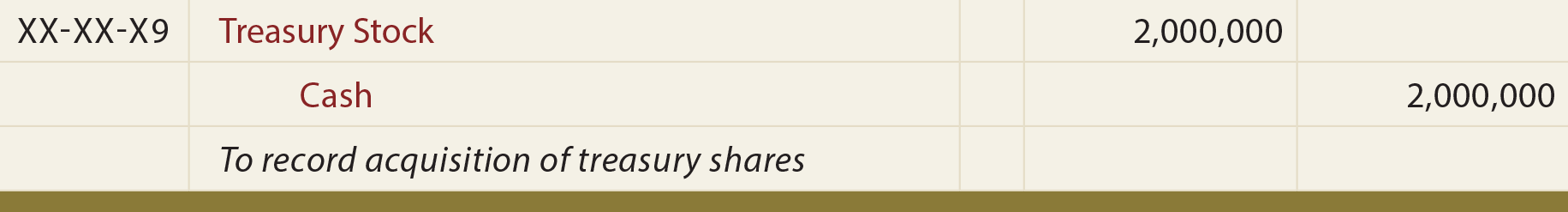

There are two methods possible toaccount for treasury stock—the cost method, which is discussedhere, and the par value method, which is a more advanced accountingtopic. The cost method is so named because the amount in theTreasury Stock account at any point in time represents the numberof shares held in treasury times the original cost paid to acquireeach treasury share. When a company purchases treasury stock, it is reflected on the balance sheet in a contra equity account.

Understanding Stockholders’ Equity

They are a distribution of the net income of a company and are not a cost of business operations. Treasury stock transactions have no effect on the number of shares authorized or issued. Because shares held in treasury are not outstanding, each treasury stock transaction will impact the number of shares outstanding. When stock is repurchased for retirement, the stock must be removed from the accounts so that it is not reported on the balance sheet. The balance sheet will appear as if the stock was never issued in the first place.

Issuing Common Stock with a Par Value in Exchange for Property or Services

Figure 14.5 shows what the equity section of the balance sheet will reflect after the preferred stock is issued. Later, on June 30, we have received a cash dividend of $5,000 from this investment that we have made in the shares of ABC Corporation. The other companies’ share is also part of the marketable security. So when the company purchases other shares, it has to record this investment as the marketable security.

Again, the number of shares will not be reflected anywhere in the accounting system. Your requirement for noting the number of shares purchased is not part of the double entry accounting system. Tracking share purchases in a double-entry bookkeeping system goes outside my knowledge, and I would be glad of advice. Currently, only actual journals (purchases, sales, credit notes, cheques, deposits, transfers, etc.) are recorded in the system.

A reverse stock split occurs when a company attempts to increase the market price per share by reducing the number of shares of stock. For example, a 1-for-3 stock split is called a reverse split since it reduces the number of shares of stock outstanding by two-thirds and triples the par or stated value per share. The effect on the market is to increase the market value per share.

The related journal entry is a fulfillment of the obligation established on the declaration date; it reduces the Cash Dividends Payable account (with a debit) and the Cash account (with a credit). Note that dividends are distributed or paid only to shares of stock that are outstanding. Treasury shares are not outstanding, so no dividends are declared or distributed for these shares.

The Walt Disney Company has consistently spent a large portion of its cash flows in buying back its own stock. According to The Motley Fool, the Walt Disney Company bought back 74 million shares in 2016 alone. Read the Motley Fool article and comment on other options that Walt Disney may have had to obtain financing. Auditor’s statement is required that they have enquired into the company’s state of affairs. Where certain qualifying conditions are met, the proceeds from the buyback are taxed as a capital gain instead of being taxed as a dividend. Capital gains tax treatment applies automatically where the conditions are met so it is not necessary to claim CGT treatment.

The hope is that the market price of these shares will appreciate in value and/or dividends will be received before the money is needed for operations. Such investments can be held for a few days (or even hours) or many years. Although earnings can improve through this strategy, the buyer does face additional risk. Share prices do not always go up; they can also decline resulting in losses for the investor. A traditional stock split occurs when a company’s board of directors issue new shares to existing shareholders in place of the old shares by increasing the number of shares and reducing the par value of each share. For example, in a 2-for-1 stock split, two shares of stock are distributed for each share held by a shareholder.