Most investors, such as private equity firms and venture capitalists, prefer companies with high operating leverage because it makes growth faster and easier. This approach produces 2.0x for the software company vs. 1.0x for the services company, which understates the operating leverage differences. Regardless of whether revenue increases or decreases, the margins of the company tend to stay within the same range. If all goes as planned, the initial investment will be earned back eventually, and what remains is a high-margin company with recurring revenue.

- At the end of the day, the firm’s profit margin can expand with earnings increasing at a faster rate than sales revenues.

- However, the risk from high operating leverage also depends on the company’s overall Operating Margins.

- That indicates to us that this company might have huge variable costs relative to its sales.

- It should be noted that equity shareholders are entitled to the remainder of the operating profits of the firm after meeting all the prior obligations.

- Operating leverage measures a company’s ability to increase its operating income by increasing its sales volume.

Mục Lục Bài Viết

Degree of operating leverage formula

In fact, the relationship between sales revenue and EBIT is referred to as operating leverage because when the sales level increases or decreases, EBIT also changes. Most of Microsoft’s costs are fixed, such as expenses for upfront development and marketing. With each dollar in sales earned beyond the break-even point, the company makes a profit, but Microsoft has high operating leverage.

Can I Use DOL to Compare Different Companies?

A company with a high financial leverage will need to have sufficiently high profits in order to pay off its debt obligations. On the other hand, if the case toggle is flipped to the “Downside” selection, revenue declines by 10% each year, and we can see just how impactful the fixed cost structure can be on a company’s margins. Now, we are ready to calculate the contribution margin, which is the $250mm in total revenue minus the $25mm in variable costs. Therefore, each marginal unit is sold at a lesser cost, creating the potential for greater profitability since fixed costs such as rent and utilities remain the same regardless of output.

How Does Cyclicality Impact Operating Leverage?

It is important to compare operating leverage between companies in the same industry, as some industries have higher fixed costs than others. That’s to say, operating leverage appears where there is a fixed financial charge (interest on debt and preference dividend). To calculate both operating leverage and financial leverage, EBIT is referred to as the linking point in the study of leverage. When calculating the operating leverage, EBIT is a dependent variable that is determined by the level of sales.

The contribution margin represents the percentage of revenue remaining after deducting just the variable costs, while the operating margin is the percentage of revenue left after subtracting out both variable and fixed costs. Intuitively, the degree of operating how to get around turbotax says “medical expenses leverage (DOL) represents the risk faced by a company as a result of its percentage split between fixed and variable costs. In fact, operating leverage occurs when a firm has fixed costs that need to be met regardless of the change in sales volume.

Degree of Operating Leverage (DOL): What Is It, Calculation & Importance

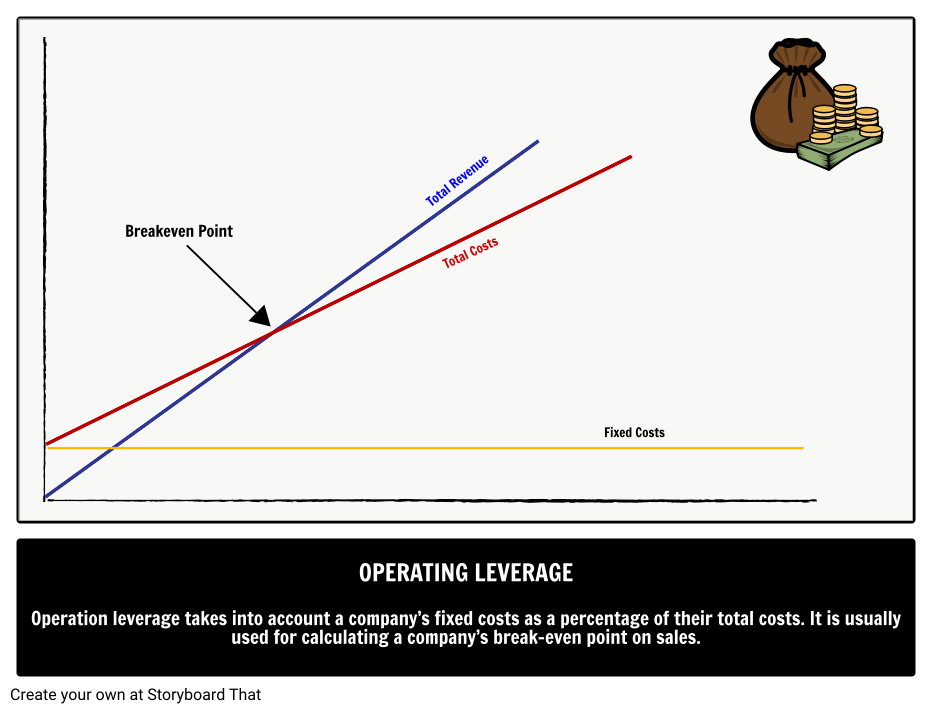

Operating leverage is a financial efficiency ratio used to measure what percentage of total costs are made up of fixed costs and variable costs in an effort to calculate how well a company uses its fixed costs to generate profits. The operating leverage formula is used to calculate a company’s break-even point and help set appropriate selling prices to cover all costs and generate a profit. This can reveal how well a company uses its fixed-cost items, such as its warehouse, machinery, and equipment, to generate profits. The more profit a company can squeeze out of the same amount of fixed assets, the higher its operating leverage. The formula can reveal how well a company uses its fixed-cost items, such as its warehouse, machinery, and equipment, to generate profits. Companies with high fixed costs relative to variable costs will exhibit high operating leverage, meaning their earnings are more volatile with changes in sales.

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. These two costs are conditional on past demand volume patterns (and future expectations). Furthermore, another important distinction lies in how the vast majority of a clothing retailer’s future costs are unrelated to the foundational expenditures the business was founded upon.

If fixed costs are high, a company will find it difficult to manage short-term revenue fluctuation, because expenses are incurred regardless of sales levels. This increases risk and typically creates a lack of flexibility that hurts the bottom line. Companies with high risk and high degrees of operating leverage find it harder to obtain cheap financing. A high DOL indicates that a company has a larger proportion of fixed costs compared to variable costs.

An example of a company with a high DOL would be a telecom company that has completed a build-out of its network infrastructure. The catch behind having a higher DOL is that for the company to receive positive benefits, its revenue must be recurring and non-cyclical. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

These industries have higher raw material costs and lower comparative fixed costs. For example, for a retailer to sell more shirts, it must first purchase more inventory. When a restaurant sells more food, it must first purchase more ingredients. The cost of goods sold for each individual sale is higher in proportion to the total sale. For these industries, an extra sale beyond the breakeven point will not add to its operating income as quickly as those in the high operating leverage industry. Unfortunately, unless you are a company insider, it can be very difficult to acquire all of the information necessary to measure a company’s DOL.